The new and improved SIM that protects!

Introducing TONE WOW Lindung 2.0! The Prepaid SIM card for ALL your communication and protection needs!

Offering FREE Insurance Protection up to RM54,000 along with modern Prepaid service and awesome Plans to suit your modern lifestyle.

TONE WOW LINDUNG – Always Connected, Always Protected!

What can I get with TONE WOW LINDUNG?

PA Takaful

FREE Takaful Protection of up to RM50,000

Life Insurance

FREE Insurance Protection of up to RM4,000

The awesome LINDUNG Data Plan

Special for our non-LINDUNG Customers. Subscribe and get hi-speed Data AND Takaful Protection

Earn monthly income

Now you can earn MORE with our new and higher commission.

Awesome benefits

Enjoy numerous TONE WOW subscriber benefits that will make you smile

Simplified processes

Streamline processes, ease networker stay focus on earn money

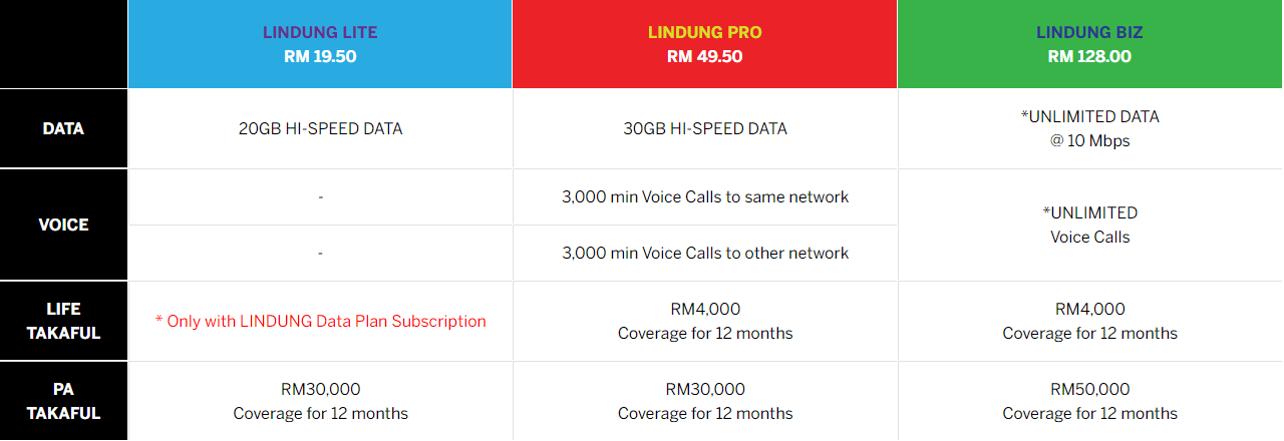

Which SIM would you choose?

RM 19.50 |

RM 49.50 |

RM 128.00 |

|

|---|---|---|---|

| 20GB HI-SPEED DATA*** | 70GB HI-SPEED DATA | 225GB HI-SPEED DATA | |

| - | UNLIMITED* | *UNLIMITED | |

| - | - | ||

| RM4,000 Coverage for 12 months |

RM4,000 Coverage for 12 months |

||

| RM30,000 Coverage for 12 months |

RM30,000 Coverage for 12 months |

RM50,000 Coverage for 12 months |

NOTE :

*UNLIMITED Calls are subject to Fair Usage Policy (FUP)

All packages are subject to change without any prior notice and also subject to Terms and Conditions.

Effective 1st May 2024, ALL LINDUNG LITE SIM Activations will come with Pre-load of 20GB Hi-Speed Data. >>Terms & Conditions apply.<<

Coverage will begin from the date of SIM card activation for up to 12 months, provided the SIM card remains in ACTIVE status.

No claim entitlement for death caused by motorcycle accidents.

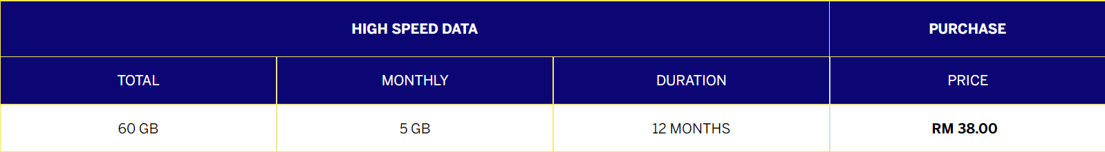

LINDUNG Data Plan. What is it?

LINDUNG Data Plan is an awesome high-speed Data Plan subscription which comes with

FREE *12-months of RM50,000 PA Takaful and RM4,000 Life Insurance coverage.

Hassle-free subscription via our own myWOW app.

Designed especially for existing TONE WOW customer (without Takaful Protection),

subscribe to this and immediately get protected!

Be a smart consumer and subscribe today. Stay connected and be protected!

All Plans and Packages are subject to change without prior notice.

No claim entitlement for death caused by motorcycle accidents.

Let's get you protected!

New customer or existing subscriber, let us know who you are. Click below.

Let us know who you are and how to reach you.

We will get in touch with you ASAP!

You are just moments away from being protected.

Follow the simple steps below to get your FREE Takaful Protection.

Step 1

Download myWOW App

Step 2

Subscribe to TONE WOW LINDUNG Data Plan

Step 3

Congratulations! You are now protected by TONE WOW LINDUNG.

FREQUENTLY ASKED QUESTIONS (FAQ)

Updated on: 13 NOV 2024

Any questions? Chances are high that you will find answers to your questions in this section. Should you require further info, clik here to send in your queries.- What is LINDUNG 2.0?

LINDUNG 2.0 is an initiative of TONE WOW to improving the quality of product and services as well as simplifying the procedure and registration process for TONE WOW users.

- How New Member want to participate in LINDUNG 2.0?

New Members that register with TONE WOW via LINDUNG 2.0 Starter Pack will be automatically participate in LINDUNG 2.0 program.

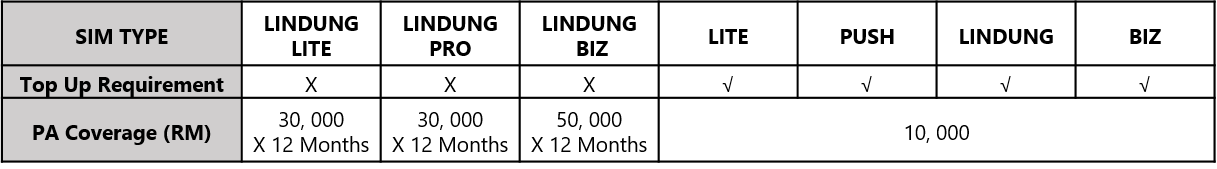

- What are the SIM types of LINDUNG 2.0 Starter Pack?

Each starter pack comes with FREE Term Takaful (except LINDUNG LITE) and FREE Takaful Personal Accident protection for 12 months. These Starter Pack also offers Data Plan, Hotspot, and unlimited offline voice calls and online voice calls with a validity period for 30 days.

More Details as below:

- How to register LINDUNG LITE, LINDUNG PRO and LINDUNG BIZ?

Non Member?

As a first time user, please contact nearest Business Partner, Branch or Service Centres.

Business Partners, Branches or Service Centres by area/region

Already a member?

Download myWOW App by TONE WOW / or log in to your TWMMS account to register your new prospect.

• Android: Click to download

• IOS => Click to download

- Is the preload in LINDUNG 2.0 Starter Pack counted as incentives?

No. it’s not counted as incentives entitlement

- When the preload in LINDUNG LITE SIM pack will be granted?

The 1st 10GB preload will be granted once the SIM card activated. An additional 10GB will be activated on the 32 days after SIM activated with the conditions line must be in ACTIVE status.

- What is the validity of 10GB data preload in LINDUNG LITE SIM?

The validity is 32 days and stackable.

- What is the minimum age to register the SIM card LINDUNG 2.0?

12 years old, but the minimum age is 18 years old to entitle for FREE Term Takaful.

- What if the customer want to register the SIM card LINDUNG 2.0 is 65 years old?

The registration can be proceed but she/he will not be entitled for FREE Term Takaful coverage.

- What is the minimum age of the person doing registration?

You are at least 18 years old age to do the registration

- Can I register the SIM card by using photocopy NRIC/Passport?

No. You must not proceed with the registration of a customer if the original and valid identification document of such customer is not made available. You shall not accept on TONE WOW behalf any third party or photocopied identification documents without sighting the ORIGINAL identification documents.

- Can I register new SIM card without the presence of customer?

You must conduct the registration in the presence of the customer (i.e. the customer must be physically present at the time of registration).

- How to purchase LINDUNG 2.0 Starter Pack?

- You may purchase from our Business Partner or visit TONE WOW HQ.

- You may also email us at orders@tonewow.net with the following details for online purchase.

- Name

- Member ID (if applicable):

- NRIC/Passport:

- Program: (TONE WOW EXCEL / TONE WOW PLUS)

- Sim card Type: (LINDUNG LITE/LINDUNG PRO/LINDUNG BIZ)

- SIM Quantity:

- Method of collection: Self collect or Courier

- For courier delivery, there is a delivery cost depend on area and weight. Minimum RM10 for Semenanjung Malaysia, RM20 for Sabah & Sarawak.

- For self-collection, you may collect from TONE WOW HQ as per address below:

TONE WOW HQ B-G-1, Jalan3/149E, Taman Sri Endah, Bangunan Endah Promenade, Bandar Baru Sri Petaling, 57000 Sri Petaling, Kuala Lumpur

Operational Hours:

Monday - Friday: 10:00AM - 5:00PM

Saturday & Sunday: CLOSED

- How long is the validity for LINDUNG 2.0 Starter Pack?

Validity as per top up denomination.

I.e. top up RM50 will get 50 validity days and after validity ends, your status will be barred for NINETY (90) days and Suspended for ONE (1) Day before expiration.

Barred for 90 days

• Able to receive incoming call but unable to make outgoing call and do not have access to internet

• You may top up to re-active your mobile number to avoid your mobile number falling into the 'Expired' status

Suspended for ONE (1) day

• Unable to receive and make call and access internet

• You may top up to re-active your mobile number to avoid your mobile number falling into 'Expired' status

SIM Lifecycle à Active > Barred (90 days) > Suspended (1 day) > Expired

- How existing TONE WOW member want to join LINDUNG 2.0?

Purchase LINDUNG 2.0 Data Plan. For more details, refer to link

- Can I register LINDUNG 2.0 SIM card if I’m enjoying the existing FREE LIFE Insurance?

Yes, you would need to acknowledge and agree that your existing LIFE insurance and Takaful Personal Accident will be replaced with the FREE Term Takaful without compensation for TONE WOW members with existing LIFE insurance by registering the Starter Pack (LINDUNG PRO or LINDUNG BIZ) of TONE WOW LINDING 2.0.

- What does LINDUNG 2.0 Data Plan offers to existing TONE WOW Members?

Refer to the link for the LINDUNG 2.0 Data Plan details.

- Is the TONE WOW LINDUNG members will receive data and FREE Takaful coverage if their mobile status is barred?

No. All TONE WOW LINDUNG members mobile number must be in ACTIVE status at all times (able to make call and receive call) in order to receive data and free Takaful coverage.

- What happen to the data that I supposed to received but my line in barred status?

The data will be forfeited and no replacement or compensation for the data

- Can I upgrade my current rank from LITE to BIZ?

Yes, you can upgrade to BIZ Member through myWOW app by make payment RM100.00 through WOWlet in your myWOW apps.

- What is the maximum coverage value of FREE Term Takaful for LITE Member that have TONE WOW LINDUNG category B and upgrade to BIZ?

You need to agree to forfeit the existing TONE WOW LINDUNG category B in order to proceed the membership upgrade to BIZ and covered with RM4, 000 for FREE Term Takaful.

- When my subsequent FREE Term Takaful and FREE Takaful Personal Accident is will be renew?

The subsequent FREE Term Takaful will be renewed on monthly basis for TONE WOW Members who are in Active (able to make call and receive call) status only and FREE Takaful Personal Accident will be renew on or before 7th of the following month for TONE WOW Members who are in ACTIVE (able to make call and receive call) status only with fulfilment of Reload and Beneficiary requirement.

- Can I upgrade my current rank from PUSH/LINDUNG/PRO to BIZ?

Yes, you can upgrade to BIZ Member through myWOW app by make payment RM50.00 through WOWlet in your myWOW apps.

- Is the New members that registered via TONE WOW LINDUNG STARTER PACK and existing members subscribed to TONE WOW LINDUNG Data Plan are entitled for Khairat Kematian claim?

No, new members that registered via TONE WOW LINDUNG STARTER PACK and existing members subscribed to TONE WOW LINDUNG Data Plan will not be entitled for Khairat Kematian claim. For more info and Term and conditions at https://www.tonewow.net/en/benefits/khairat_kematian.

- Can I exchange my unregistered SIM cards (Flexi LITE/Flexi Push/ Flexi LINDUNG/ Flexi BIZ to TONE WOW LINDUNG 2.0 Starter Pack?

Yes. You may email us at support@tonewow.net or contact us via WhatsApp Support at +6010-5129768 with the details below:

Name:

NRIC/Passport:

Member ID:

Phone No. :

SIM Serial number list want to exchange:

SIM card type:

- I have already purchased LINDUNG BIZ SIM card. Can I register and remain my existing number (other telco)?

Yes, can. During registration, make sure you tick ‘MNP’ to remain your existing mobile number

- Can I purchase Flexi LITE/PUSH/LINDUNG or BIZ SIM card after LINDUNG 2.0 has launched?

No, cannot. We have stop selling all that type of SIM cards effective 26th July 2023.

- Can I register my existing SIM card Flexi LITE, PUSH, BIZ or LINDUNG after phased out on 2nd August 2023?

Yes. You still can register the SIM card

- Is there any minimum purchase of LINDUNG 2.0 Starter Pack?

No. There is no minimum purchase for LINDUNG 2.0 Starter Pack

- Can I register another account in LINDUNG 2.0 although I have an account in TONE WOW?

Yes, but 1 NRIC /Passport is entitle for 1 Takaful Personal Accident and 1 FREE Term Takaful. And you can register up to FIVE (5) accounts (Inclusive of Digi accounts).

- How do I update my profile details?

You may login to myWOW Apps/ TWMMS https://www.tonewow.net/twmain/ to update your profile

- Is TONE WOW member not update the beneficiary info in TWMMS are entitled for and Takaful Personal Accident claim?

No. TONE WOW Members that are qualified for FREE Term Takaful and Takaful Personal Accident but did not complete the beneficiary info in TWMMS https://www.tonewow.net/twmain/are not entitled to FREE Term Takaful and Takaful Personal Accident Claim.

- Who can I contact if I have an inquiry or need assistance?

You may reach us via the below channels:-

- Who can I contact if I have an inquiry or need assistance?

You may reach us via the below channels:-- WhatsApp – 0105129768 (8am – 8pm daily)

- Call - 01159000969 or 01159009969 (8am – 10pm daily)

- Email – support@tonewow.net

- Walk-in to TONE WOW HQ Office

TONE WOW HQ B-G-1, Jalan3/149E, Taman Sri Endah, Bangunan Endah Promenade, Bandar Baru Sri Petaling, 57000 Sri Petaling, Kuala Lumpur

Operational Hours:

Monday - Friday: 10:00AM - 5:00PM

Saturday & Sunday: CLOSED

- What is LINDUNG 2.0 Data Plan?

A data plan that offering FREE Term Takaful and Takaful Personal Accident protection to the existing TONE WOW Members.

- What does the LINDUNG 2.0 Data Plan offers to existing TONE WOW Members?

- How to purchase LINDUNG 2.0 data plan?

TONE WOW Members can purchase LINDUNG 2.0 data plan via the following method:- Purchase via WOWlet in myWOW apps

- Purchase via WOWcher redemption in myWOW apps

- Purchase by walk in at TONE WOW HQ counter

- How many months will I receive the Data TWC5 (5GB) once purchased the data plan?

12 months

- I have already purchased LINDUNG 2.0 Data Plan, when is my Data TWC5 (5GB) will be granted?

Within 24 hours upon the purchase and the subsequent Data TWC5 (5GB) will be granted on the same date as first data granted to those who are in Active (able to make call and receive call) status only

- Can I purchase more than 1 LINDUNG 2.0 Data Plan?

One (1) NRIC/Passport can purchase for ONE (1) LINDUNG 2.0 Data Plan only

- Is LINDUNG 1.0 Data Plan and LINDUNG 2.0 Data Plan can be coexist?

No. It’s not coexist.

- What is the LINDUNG 2.0 Data Plan’s validity for Data TWC5 (5GB)?

32 days

- Is the members will receive Data TWC5 (5GB) if their mobile number status is barred?

No. Member’s mobile number must be in ACTIVE status at all times (able to make call and receive call) in order to receive data. No replacement and compensation will be given.

- Is the Data TWC5 (5GB) can be transferred to other mobile number?

No. Data is not transferrable.

- Is the Data TWC5 (5GB) is auto renewal?

No, but you have to ensure your mobile number stay in Active status at all time (able to make call and receive call) in order to receive data. No replacement and compensation will be given.

- Is the Data TWC5 (5GB) balance will be roll-over?

Yes, within and before the validity ends.

- Can I still use my Data TWC5 (5GB) when the status in Barred?

No. You need to perform top up to use the Data TWC5 (5GB).

- What happen to my LINDUNG 2.0 Data Plan and credit balance when SIM card expired?

All data balance and credit balance will be forfeited. You need to register new SIM card and repurchase the LINDUNG 2.0 Data Plan again.

- What happen if my Data TWC5 (5GB) quota has been used up?

You need to purchase new data plan. You can refer to link for data plans available.

- What is the age range to be entitled for FREE Takaful Personal Accident?

Age between 12 to 75 years (date of birth)

- How do existing TONE WOW Members apply for the FREE Takaful Personal Accident?

Existing members can purchase LINDUNG 2.0 Data Plan. Click this link for LINDUNG 2.0 Data Plan details.

- How TONE WOW Members can purchase LINDUNG 2.0 Data Plan?

TONE WOW Members can purchase data plan via any of the following channels;- Purchase via WOWlet in myWOW apps

- Purchase via WOWcher redemption in myWOW apps

- Purchase by walk in through TONE WOW HQ counter

- What are the requirements to be entitled for Free Personal Accident Takaful?

TONE WOW Members, who are Malaysian and foreigners with valid passport and/or valid work permit, between age 12 to 75 years old (date of birth) are eligible for FREE Takaful Personal Accident, subjected to fulfilment of following:- For TONE WOW Members who are registered using the LITE, PUSH, LINDUNG or BIZ SIM card(s), their total minimum monthly reload of RM 30 from any channel in a single denomination.

- For TONE WOW Members who are registered using the SIM card of LINDUNG LITE, LINDUNG PRO, LINDUNG BIZ, they must maintain an active Tone Wow mobile number (able to make and receive calls) throughout the 12 months period from the SIM activated, or subscribing to TONE WOW LINDUNG 2.0 Data Plan.

- Completed Beneficiary details in TONE WOW Membership Management System (TWMMS) https://www.tonewow.net/twmain/

- Am I entitled for Khairat Kematian if I am covered by FREE Takaful Personal Accident?

No. You will not be entitled for Khairat Kematian claim. For more info and Term and conditions at https://www.tonewow.net/en/benefits/khairat_kematian.

- What is the period to claim for FREE Takaful Personal Accident?

The claim period is within twelve (12) consecutive month’s results in death or disablement

- Am I entitled for claim if my mobile number is in barred status?

No. Your mobile number must be in ACTIVE status at all times for claim

- Am I still covered by FREE Takaful Personal Accident if my mobile number is in barred status?

No. Your mobile number must be in ACTIVE status at all times (able to make call and receive call) in order to entitle FREE Takaful Personal Accident coverage.

- What is the coverage duration of the FREE Takaful Personal Accident?

12 months on monthly renewal basis.

- Does the FREE Takaful Personal Accident also cover a member who is already has pre-existing illness?

No.

- Will I be covered if I travel outside of Malaysia?

Yes. You are covered.

- Would a driver be covered by Takaful and be eligible for claims if, he/she dies or sustains permanent disability (PD) due to vehicle accident while driving without a valid driving license?

No. The insured driver MUST have a valid driving license. Without it, claim will be rejected.

- What are the exclusions in FREE Takaful Personal Accident?

We shall not be liable for claims directly or indirectly caused by or which results from:

You, when engaging in or taking part in (in duty);

- Armed forces, naval or air force service or operations;

- Professional sports, winter sports other than skating;

- Divers, Soldiers/Military and Law Enforcement Officers, Aircraft Testers, Pilots and Flight Crew, Sailors and Sea Fisherman, Race Car Drivers, Jockeys, Oil Rig Workers, Log Sawyers and Lumber Workers, Firefighters, War Correspondents, Tower Builders, Cargo Unloaders, Persons Involved in Building Demolition, Persons Involved in Ambulance Services, Carpentry Machinists, Explosives Handlers, Tunnelling and Underground Mining and Professional Sports Activities

You, when involved in a motorcycle accident (Rider and passenger)

- Does FREE Takaful Personal Accident cover the on and off duty armed forces?

No. not cover

- Does FREE Takaful Personal Accident cover the on and off duty Fireman?

No. not cover

- Does FREE Takaful Personal Accident cover the on and off duty police - special task forces?

Yes, only Police category

- I have registered multiple account in TONE WOW. Am I entitled for additional claim?

No. If the same Person Covered has more than One (1) inforce certificates of Takaful, we will only honour the claims under One (1) certificate of Takaful which has the highest benefits limits.

- How do I ensure my FREE Takaful Personal Accident will be renewed every month?

Your TONE WOW line must be in Active status (able to make call and receive call) for every month.

- How to be entitled for Takaful coverage for Non LINDUNG 2.0 member(s), existing LINDUNG 2.0 member(s) (LITE, PRO, BIZ) and LINDUNG Data Plan that has ended after 12 months?

- Personal Accident (PA) Takaful – RM10, 000 – Minimum top up of RM30 from any channel for every month in single denomination.

- Personal Accident (PA) Takaful- RM50, 000 & LIFE Takaful- RM4, 000 – Subscribe or redeem LINDUNG Data Plan.

- What is the claim value for free Takaful Personal Accident for member’s that ended their 12 months coverage?

The total claim for personal accident Takaful is RM10, 000 with the condition that the member must make a minimum top-up of RM30 from any channel in one denomination every month.

- What is the entitlement for Personal Accident Takaful effective 1st July 2024 for LINDUNG 2.0 SIM (LITE, PRO, BIZ) or SIM LINDUNG 1.0 that has been sold and registered or not register yet?

LINDUNG 2.0 SIM

LITE:

No coverage for motorcycle accident (Rider/ Passenger)

Personal Accident Takaful – RM30, 000PRO:

No coverage for motorcycle accident (Rider/ Passenger)

Personal Accident Takaful – RM30, 000

LIFE Takaful – RM4, 000BIZ:

No coverage for motorcycle accident (Rider/ Passenger)

Personal Accident Takaful – RM50, 000

LIFE Takaful – RM4, 000SIM LINDUNG 1.0

No coverage for motorcycle accident (Rider/ Passenger)

Personal Accident Takaful – RM10, 000

- What should I do if I want to enjoy the maximum benefit from LIFE Insurance and Personal Accident Takaful?

You may subscribe or redeem LINDUNG 2.0 Data Plan.

You may subscribe or redeem LINDUNG 2.0 Data Plan.

- Are TONE WOW member(s) entitled for LIFE Insurance claim if they died due to motorcycle accident?

Yes, they are entitled for LIFE Insurance claim.

- How to check the details of FREE Takaful Personal Accident?

TONE WOW members can logon to TONE WOW Membership Management System (TWMMS) https://www.tonewow.net/twmain/ to check the details of FREE Takaful Personal Accident

- Do I need to update my beneficiary details in TONE WOW Membership Management System (TWMMS)?

Yes. All beneficiary details must be completed upon activation of SIM Card under TONE WOW LINDUNG 2.0 (LINDUNG LITE, LINDUNG PRO or LINDUNG BIZ) or upon subscription of LINDUNG 2.0 Data Plan to be eligible for FREE Takaful Personal Accident. You will not eligible for the claims if the beneficiary details is incomplete.

- How do I update my beneficiary in TONE WOW Membership Management System (TWMMS)?

Logon to your TONE WOW Membership Management System (TWMMS) https://www.tonewow.net/twmain/ and update the beneficiary details.

- How to claim the FREE Takaful Personal Accident?

-

Written notice send via email to support@tonewow.net - Certified True Copy (CTC) of the following documents must be submitted:

- Copy of death certificate (for death claim)

- Copy of post mortem report (for death claim)

- Copy of nominee’s /claimant/s identity card and proof of relationship

- Medical specialist report and assessment of the disability done within 12 months after the date of accident (for PD claim)

- Copy of police report on the alleged accident

- Medical report any other documents to support the claim

- Copy of Insured / Deceased’s identity card and driving license (For motor vehicle accident)

- Made by the beneficiary named by the member in TONE WOW Member Management System (TWMMS) if request is under death claim.

- Written notice of claim together with supporting documents must be given to TONE WOW within ninety (90) days after the date of death of the Member. Failure to give notice within such time shall not invalidate any claim if it shall be shown not to have been reasonably possible to give such notice and the notice was given as soon as was reasonably possible.

-

- Where can I find the Master Certificate and Product Disclosure of FREE Takaful Personal Accident?

You may find the Master Certificate & Product Disclosure in the links below;

Master Certificate

Product Disclosure

- Who should I contact if I have any enquiry related to FREE Takaful Personal Accident?

For inquiries regarding FREE Takaful Personal Accident, member can contact TONE WOW Customer Service by call at 01159000969 or 01159009969 (8am – 10pm daily) or by WhatsApp at 0105129768 (8am – 8pm daily)

Free Life Insurance FAQs

- What is the age range to entitle for Free Life Insurance?

Aged between eighteen (18) years to sixty-five (65) years old (year of birth)

- How do existing TONE WOW Members apply for the Free Life Insurance?

Existing TONE WOW Members can purchase LINDUNG 2.0 Data Plan. Scroll up for info on LINDUNG 2.0 Data Plan details.

- How to purchase LINDUNG 2.0 Data Plan?

TONE WOW Members can purchase LINDUNG 2.0 data plan via any of the following channels;- Purchase via WOWlet in myWOW apps

- Purchase via WOWcher redemption in myWOW apps

- What are the requirements to be entitled for the Free Life Insurance?

TONE WOW Members who are Malaysian and foreigners with valid ID/passports and/or valid work permits are eligible for the Free Life Insurance coverage, subject to fulfilment of the following requirements:- Aged between eighteen (18) years to sixty-five (65) years old (year of birth).

- Upon activation of SIM Card under TONE WOW LINDUNG 2.0 (LINDUNG PRO or LINDUNG BIZ) or by subscribing to TONE WOW LINDUNG 2.0 Data Plan.

- Must maintain an active Tone Wow mobile number throughout the twelve (12) months period from the date the SIM card is activated under TONE WOW LINDUNG 2.0 (LINDUNG PRO or LINDUNG BIZ) or upon subscription to TONE WOW LINDUNG 2.0 Data Plan.

- Beneficiary or nomination details must be completed and updated in TONE WOW Membership Management System (TWMMS) prior to making a claim.

- Am I entitled to Khairat Kematian if I am being covered by Free Life Insurance?

No. You will not be entitled for Khairat Kematian claim. For more info and Terms and conditions please visit https://www.tonewow.net/en/benefits/khairat_kematian.

- What is the timeframe to claim for Free Life Insurance?

The claim must be done within 30 days after the date of death and must be submitted with Certified True Copy (CTC) documents.

- What is the coverage value for Free Life Insurance?

The coverage value is a maximum of RM 4,000.00.

- Am I still covered by Free Life Insurance if my TONE WOW mobile number is in barred status?

No. Your TONE WOW mobile number must always be in ACTIVE status in order to be entitled for the monthly renewal and coverage of the Free Life Insurance.

- What is the coverage duration of the Free Life Insurance?

12 months on a monthly renewal basis.

- Does the Free Life Insurance also cover a member who already has pre-existing illness?

Yes.

- Is death by suicide eligible for Free Life Insurance coverage?

No benefit shall be payable in the event of suicide within one (1) year from the Effective Date of Individual Assurance.

- What is the termination of coverage for the insured?

The assurance of a Life Assured shall terminate:-- On the date of termination of employment with the Policy Owner.

- The date on which the Life Assured enters full-time military, naval or air service.

- date on which the Company communicates to the Policy Owner on account of war, or an act of war, such date being determined at the discretion of the Company.

- Is Free Life Insurance coverage applicable when traveling outside of Malaysia?

Yes.

- I have registered multiple accounts in TONE WOW. Am I entitled for any additional claims?

No. If the same Member or Person Covered has more than one (1) in-force certificate, we will only honour the claims under one (1) certificate with the highest benefit limits.

- How do I ensure my Free Life Insurance is renewed every month?

Your TONE WOW mobile number must be in Active status.

- How do I check the details for Free Life Insurance?

TONE WOW members can logon to TONE WOW Membership Management System (TWMMS) https://www.tonewow.net/twmain/ to check the details of Free Life Insurance.

- Do I need to update my beneficiary details in TONE WOW Membership Management System (TWMMS)?

Yes. Beneficiary or nomination details must be completed and up to date in TONE WOW Membership Management System (TWMMS) prior to making a claim.

- How do I update my beneficiary details in TONE WOW Membership Management System (TWMMS)?

Login to your TONE WOW Membership Management System (TWMMS) https://www.tonewow.net/twmain/ and update the beneficiary details.

- How do I make a claim for Free Life Insurance?

- Written notice (within thirty (30) days after the date of death of the Member) by email to support@tonewow.net

- Certified True Copy (CTC) of the following documents must be submitted:

- Duly completed death claim form

- Copy of the death certificate

- Copy of post-mortem report (for accidental death)

- Copy of Member/Person Covered/Deceased NRIC/Passport

- Copy of Police Report (for accidental death)

- Copy of beneficiary/nominee’s/claimant’s NRIC/Passport

- Proof of claimant’s relationship with the Insured Person

- Any other document to support the claim (if required)

- Where can I find the Master Certificate of Free Life Insurance?

Click/Press >> Master Certificate

- Who should I contact if I have any inquiries related to Free Life Insurance?

For inquiries regarding the Free Life Insurance, kindly contact TONE WOW Customer Service by calling 01159000969 or 01159009969 (8.00 am – 10.00 pm daily) or by WhatsApp at 0105129768 (8.00 am – 10.00 pm daily).

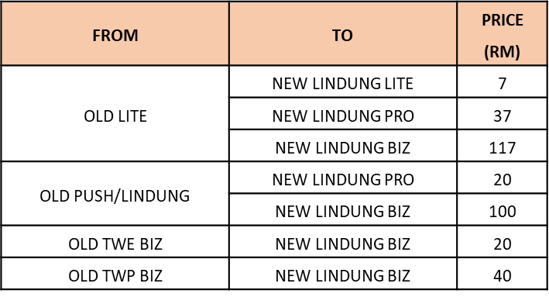

- What is the type of SIM upgrade that available?

There are 2 types of SIM upgrade;- Bulk SIM upgrade

- SIM upgrade during registration

- What is the bulk SIM upgrade?

To upgrade un-registered old SIM cards (LITE/PUSH/LINDUNG 1.0/BIZ) to LINDUNG 2.0 SIM cards as bulk.

- What is SIM upgrade during registration?

To upgrade OLD SIM types and LINDUNG 2.0 SIM during registration

- What is the procedure for bulk SIM upgrade?

- Send request to support email support@tonewow.net

- Fill-in the Upgrade Request Form attached in the email reply.

- Make payment for total SIM to upgrade (support will provide TW HQ bank account details in the email)

- HQ will check the status per SIM (must be Un-registered and un-expired SIM)

- Once upgraded to LINDUNG 2.0 SIM, member can proceed for SIM registration.

- All the SIMs will be upgraded as bulk following the SIM range provided by members.

- What is the procedure for SIM upgrade during registration?

- Member doing registration via WOWdaftar or myWOW.

- After member scan or manually input the SIM serial in SIM serial details section, SIM type detected and there is an option to upgrade SIM type with 'Upgrade SIM Pack' function.

- The upgrade fee will be displayed along with the selected upgrade SIM type. The payment will be deducted from the member's WOWlet.

- SIM will be upgraded once the payment deducted and registration submitted successfully.

- What happen to the SIM card that member submitted for upgrade during registration when their MNP process not successful?

The SIM card will be upgraded and can be used to register for other subscriber if the MNP process (remain old number) for previous subscriber not successful.

-

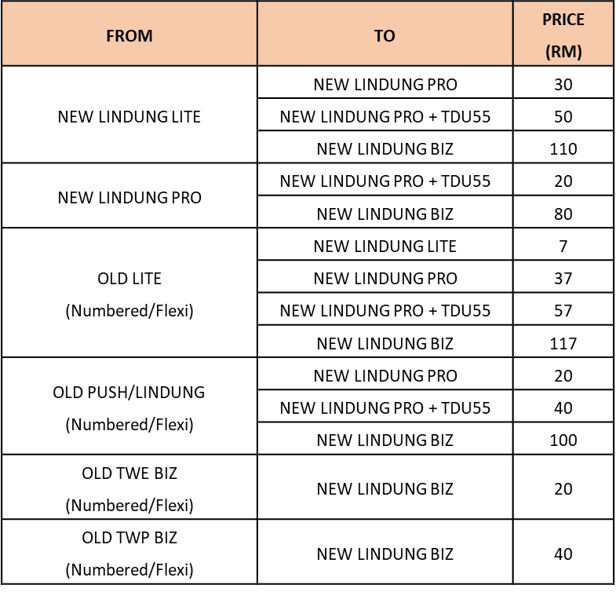

What is the type of SIM card available and the amount member need to pay for bulk SIM upgrade?

- What is the type of SIM card available and the amount member need to pay for SIM upgrade during registration?

- What is the benefits once the SIM card upgraded to LINDUNG 2.0 SIMs?

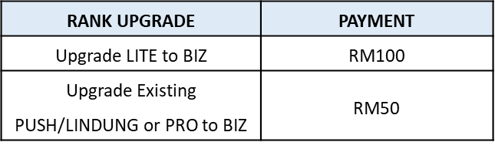

- What is the ranking available for upgrade?

- Upgrade LITE to BIZ

- Upgrade PUSH/LINDUNG or PRO to BIZ

- How to upgrade ranking?

- TONE WOW Member login to their myWOW app account

- Click at membership upgrade function

- Enter Member ID to upgrade and click 'Verify' button

- System displays current ranking of member and fee required for upgrade.

- Member need to click ‘next’ button to submit the upgrade

- Fees for upgrade will be deducted from member's WOWlet.

- The member will upgrade to new ranking within 24 hours after payment successful

- What is the price for ranking upgrade?

- When will a member upgrade to new ranking?

The member will upgrade to new ranking within 24 hours after payment successful.

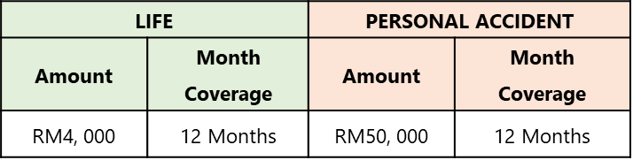

- What is the benefits when TONE WOW member upgrade ranking to BIZ?

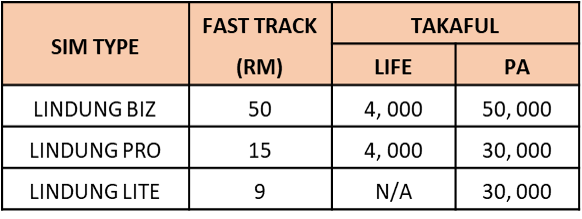

The member entitled for FREE LIFE and Personal Accident Takaful as details below;

- What happen to FREE Takaful Personal Accident coverage RM30, 000 when LINDUNG LITE/PRO members upgrade rank to LINDUNG BIZ?

The coverage amount will upgrade to RM50, 000 once LINDUNG LITE/PRO members upgrade rank to LINDUNG BIZ.

- What happen if the LITE member age below 18 or 61 years old and above upgrade ranking to BIZ member?

The member will upgrade to BIZ member but he/she not entitled for FREE LIFE Takaful coverage.

- When will the incentive with the new ranking will be calculated?

The incentive as new ranking will be calculated starting from the date of upgrade ranking.

- When will the FREE LIFE Takaful and FREE Personal Accident Takaful will be enforced once upgraded to new ranking?

FREE LIFE Takaful will be enforced immediately. While, FREE Personal Accident Takaful will be enforced on the subsequent month.

TERMS & CONDITIONS

Updated on: 13 NOV 2023

FREE LIFE INSURANCE

- The Free Group Term Life (GTL) coverage is subject to the acceptance of AmMetLife, clearance of regulatory due diligence sanction screening and subject to the terms and conditions of the AmMetLife Master Certificate issued and underwritten by AmMetLife.

- Eligibility Requirement.

TONE WOW Members who are Malaysian and Non-Malaysian with valid ID/passports and/or valid work permits are eligible for the Free Life Insurance coverage, subject to fulfilment of the following requirements:- Aged between eighteen (18) years to sixty-five (65) years old (year of birth).

- Upon activation of SIM Card under TONE WOW LINDUNG 2.0 (LINDUNG PRO or LINDUNG BIZ) or by subscribing to TONE WOW LINDUNG 2.0 Data Plan.

- Must maintain an active Tone Wow mobile number throughout the twelve (12) months period from the date the SIM card is activated under TONE WOW LINDUNG 2.0 (LINDUNG PRO or LINDUNG BIZ) or upon subscription to TONE WOW LINDUNG 2.0 Data Plan.

- Beneficiary or nomination details must be completed and up to date in TONE WOW Membership Management System (TWMMS) prior to making a claim.

- TONE WOW Members who meet/fulfil all the requirements stated in sections 2 (I), (II), (III), and (IV) above are referred to as the “Eligible Subscriber(s)”.

- TONE WOW reserves the right to change the Eligibility Requirements in sections 2 (I), (II), (III), and (IV).

- AmMetLife has the absolute right to approve or reject an Insurance claim submission in the event of any breach of the terms and conditions herein and under the AmMetLife Master Certificate.

- Free Life Insurance Coverage

- One (1) TONE WOW Member NRIC/Passport is entitled to one (1) Free Life Insurance Coverage with a maximum value of RM 4,000.00.

- The Free Life Insurance coverage will be effective within 24 hours upon successful activation of the TONE WOW LINDUNG 2.0 SIM Card (LINDUNG PRO or LINDUNG BIZ) or subscription to TONE WOW LINDUNG 2.0 Data Plan (“Certificate Effective Date”).

- The Free Life Insurance will be renewed on a monthly basis only for TONE WOW Members who are in active status.

- TONE WOW members that are below the age of 65 years old (year of birth) and successfully activate the TONE WOW LINDUNG 2.0 SIM Card (LINDUNG PRO or LINDUNG BIZ) or upon subscription to TONE WOW LINDUNG 2.0 Data Plan (“Certificate Effective Date”) are entitled to coverage up to 75 years old on condition that the member continues to stay active.

- No benefit shall be payable in the event of suicide within one (1) year from the Effective Date of Individual Assurance.

- Termination of Assurance.

The assurance of a Life Assured shall terminate:-- On the date of termination of employment with the Policy Owner.

- The date on which the Life Assured enters full-time military, naval or air service.

- date on which the Company communicates to the Policy Owner on account of war, or an act of war, such date being determined at the discretion of the Company.

- Death Benefit – is payable upon death due to natural or accidental causes.

- Claim Procedure

- Written notice (within thirty (30) days after the date of death of the Member) by email to support@tonewow.net

- Certified True Copy (CTC) of the following documents must be submitted:

- Duly completed death claim form

- Copy of the death certificate

- Copy of post-mortem report (for accidental death)

- Copy of Member/Person Covered/Deceased NRIC/Passport

- Copy of Police Report (for accidental death)

- Copy of beneficiary/nominee’s/claimant’s NRIC/Passport

- Proof of claimant’s relationship with the Insured Person

- Any other document to support the claim (if required)

- Claim must be made by the beneficiary/nominee named by the Member in TONE WOW Member Management System (TWMMS).

- Beneficiary MUST be IMMEDIATE NEXT of KIN and proof of relationship must be submitted during claim.

- Any claim without nominated Beneficiary will be subject to Islamic or Civil law accordingly.

- After Certificate liability is confirmed, AmMetLife will issue payment within fourteen (14) working days. (subject to terms and conditions of AmMetLife)

- The method of Payment is by bank transfer. When submitting the Certified True Copy (CTC) documents, you must provide the bank information (Malaysian based account only) for the payment process.

- The Certificate may be void in the event of any misrepresentation, misdescription, error, omission, or non-disclosure of facts by the Member that the Member knew or ought to have known to be untrue, misleading, or relevant or that may have influence the judgment of any prudent Insurance operator.

- TONE WOW Members that are eligible for Free Life Insurance coverage will not be entitled to Khairat Kematian claim. More info and Terms and conditions at https://www.tonewow.net/en/benefits/khairat_kematian.

- TONE WOW Members who are qualified for Free Life Insurance but did not complete or update their beneficiary information in TWMMS https://www.tonewow.net/twmain/ are not entitled to Khairat Kematian or Free Life Insurance claim.

- If the same Member or Person Covered has more than one (1) in-force certificate, we will only honour the claims under one (1) certificate with the highest benefit limits.

- For inquiries regarding the Free Life Insurance, TONE WOW Members can contact TONE WOW Customer Service by calling 01159000969 or 01159009969 between (8.00 am – 10.00 pm daily) or by WhatsApp at 0105129768 between (8.00 am – 10.00 pm daily).

- TONE WOW Sdn Bhd reserves the absolute right to change Insurance Providers should it see fit.

- TONE WOW Members agree to not challenge or dispute any action or decision taken by TONE WOW and AmMetLife according to the terms and conditions herein and under the Free Life Insurance Coverage.

- TONE WOW and AmMetLife, at its sole discretion, reserve the right to continue or terminate the Certificate accordingly with or without consent from TONE WOW Members.

- The terms and conditions herein are subject to change without any prior notice and are subject to the AmMetLife Master Certificate

- Where the terms & conditions are translated into a language other than the English Language, in the event of inconsistencies, conflicts, or discrepancies between the terms and conditions set out in the English Language version and that of the other language(s), the English Language version shall prevail.

Disclaimer:

TONE WOW Sdn Bhd is partnering with AmMetLife. In no event will AmMetLife and their respective officers, directors, employees, members, shareholders, attorneys, representatives, and agents (collectively “Representatives”), be responsible or liable for any damages or losses of any kind, including but not limited to direct, indirect, incidental, consequential, special or punitive damages arising out of your entry.

TAKAFUL PERSONAL ACCIDENT (PA)

- FREE Takaful Personal Accident coverage is subjected to acceptance by Solution Risk Consultants Sdn Bhd (SOLUTIONRISK) and subject to the master certificate terms and conditions. This Takaful is underwritten by ZURICH GENERAL TAKAFUL MALAYSIA Berhad (ZURICH)

- TONE WOW, SOLUTIONRISK and/or ZURICH has the absolute right to approve or reject the FREE Takaful Personal Accident.

- TONE WOW Members, who are Malaysian and Non-Malaysian with valid passport and/or valid work permit, between age 12 to 75 years old (date of birth) are eligible for FREE Takaful Personal Accident, subject to fulfilment of the following:a) a. For TONE WOW Members who are registered under the LITE, PUSH, LINDUNG or BIZ SIM card(s), their minimum total monthly reload is RM 30 at any channel in a single denomination.

b. For TONE WOW Members who are registered using SIM card LINDUNG 2.0 (LITE, PRO, BIZ) they must maintain an active TONE WOW Mobile Number (able to make and receive calls) throughout the 12 months period from the SIM Card activation date or date of subscription to TONE WOW LINDUNG 2.0 Data Plan.

c. Completed and updated Beneficiary details in TONE WOW Membership Management System (TWMMS)

*Refer to Term and condition No.7 & 9

- Exclusion (Apply to Whole Certificate)

We shall not be liable for claims directly or indirectly caused by or which results from:

- You, when engaging in or taking part in (in duty);

- Armed forces, naval or air force service or operations;

- Professional sports, winter sports other than skating;

- Divers, Soldiers/Military and Law Enforcement Officers, Aircraft Testers, Pilots and Flight Crew, Sailors and Sea Fisherman, Race Car Drivers, Jockeys, Oil Rig Workers, Log Sawyers and Lumber Workers, Firefighters, War Correspondents, Tower Builders, Cargo Unloaders, Persons Involved in Building Demolition, Persons Involved in Ambulance Services, Carpentry Machinists, Explosives Handlers, Tunnelling and Underground Mining and Professional Sports Activities.

- You, when involved in a motorcycle accident (Rider and Passenger)

- INCLUDED Occupation cover:

You, when engaging and not engaging or taking part in and not taking part in (on and off duty);

a) Police Category

- FREE Takaful Personal Accident will be renewed on or before 7th of the following month for TONE WOW Members who are in ACTIVE (able to make call and receive call) status only with fulfilment of Reload and Beneficiary requirement.

- TONE WOW Members who currently enjoy the Personal Accident Takaful coverage and benefit at no cost, after the 12 month tenure, they will no longer be entitled to the coverage and benefit that is being offered. To continuously enjoy the coverage and the benefits of;

- Personal Accident Takaful (PA) – RM10, 000 – Minimum top up RM30 at any channel in single denomination for every month; OR

- Personal Accident Takaful (PA) – RM50, 000 & LIFE Takaful – RM4, 000 – Subscribe or redeem LINDUNG Data Plan.

- TONE WOW members whose 12 month insurance period has expired and wish to continue enjoying FREE Personal Accident Takaful protection are required to remain active throughout their service period with a minimum top up of RM30 in single denomination at any channel for every month.

- The FREE RM10, 000 Takaful Personal Accident coverage and benefit only applies to NON LINDUNG 2.0 & LINDUNG 2.0 SIM’s (LITE, PRO, and BIZ) and LINDUNG DATA PLAN subscribers whose 12 month term of insurance has expired.

- FREE Takaful Personal Accident will be enforced on the subsequent month upon fulfilment of condition stated in Terms and Condition No. 9

- One (1) TONE WOW Member NRIC/Passport is entitled to one (1) FREE Takaful Personal Accident with maximum value of RM50, 000.

- If the same Person Covered has more than One (1) inforce certificates of Takaful, we will only honour the claims under One (1) certificate of Takaful which has the highest benefits limits.

- TONE WOW Members who want to continuously enjoy the maximum benefits from LIFE Insurance and Personal Accident Takaful, they may subscribe or redeem LINDUNG Data Plan that offers coverage and free benefits as below;

- Personal Accident Takaful - RM50, 000

- LIFE Insurance – RM4, 000

- If the member’s death was due to a motorcycle accident and they have LIFE Takaful coverage, they are entitled to claim LIFE Takaful as well.

- Claim procedure for FREE Takaful Personal Accident as follows:

- Written notice send via email to support@tonewow.net

- Certified True Copy (CTC) of the following documents must be submitted:

- Copy of death certificate (for death claim)

- Copy of post mortem report (for death claim)

- Copy of nominee’s /claimant/s identity card and proof of relationship

- Medical specialist report and assessment of the disability done within 12 months after the date of accident (for PD claim)

- Copy of police report on the alleged accident

- Medical report any other documents to support the claim

- Copy of Insured / Deceased’s identity card and driving license (For motor vehicle accident)

- Made by the beneficiary named by the member in TONE WOW Member Management System (TWMMS) if request is under death claim.

- TONE WOW mobile number must be in Active (able to make call and receive call) status for the claim.

- Written notice of claim together with supporting documents must be given to TONE WOW within ninety (90) days after the date of death of the Member. Failure to give notice within such time shall not invalidate any claim if it shall be shown not to have been reasonably possible to give such notice and the notice was given as soon as was reasonably possible.

- If the insured person who is sustain from death or permanent disability (PD) wish to submit claim due to accident (driving), they need to have valid driving license. Driving vehicle without driving license is considered illegal and may contributed to rejection of claim. For claim death due to vehicle accident, police report are required.

- Zurich General Takaful Malaysia Berhad to process claim within fourteen (14) working days subject to complete documents are received.

- After certificate liability confirmed, Zurich General Takaful Malaysia Berhad will issue payment within fourteen (14) working days. (Subject to Terms and Conditions of Zurich General Takaful Malaysia Berhad)

- Method of Payment is by Internet Banking. Must provide the bank info when submit the Certified true Copy (CTC) documents for payment process.

- In the event of foreign worker who do not have valid bank account in Malaysia, payment will be made by Telegraphic Transfer (TT) method.

- SOLUTIONRISK and/or ZURICH has the absolute right to approve or reject the FREE Takaful Personal Accident claim submission.

- The Policy may be void in the event of a misrepresentation, miss-description, error, omission or non-disclosure of fact by member, which member knew or ought to have known to be untrue, misleading or relevant or which may have influenced the judgement of any prudent insurer/ Takaful operator.

- TONE WOW Members that are covered by FREE Takaful Personal Accident will not be entitled for Khairat Kematian claim. For more info and Term and conditions at https://www.tonewow.net/en/benefits/khairat_kematian.

- TONE WOW Members that are qualified for FREE Takaful Personal Accident but did not complete the beneficiary info in TWMMS https://www.tonewow.net/twmain/ are not entitled to Khairat Kematian or FREE Takaful Personal Accident Claim.

- Beneficiary info must be filled prior to the date of accident/death to claim the FREE Takaful Personal Accident or Khairat Kematian. Failure to comply, any claims will be rejected immediately.

- Beneficiary MUST be IMMEDIATE NEXT of KIN and prove of relationship certificate must be submitted during claim.

- Beneficiary age must be at least 18 years old to make a claim,

- Any claim without nominated Beneficiary will be subjected to Islamic or Civil law accordingly.

- For inquiries regarding FREE Takaful Personal Accident, TONE WOW Member can contact TONE WOW Customer Service by call at 01159000969 or 01159009969 between (8am – 10pm daily) or by WhatsApp at 0105129768 between (8am – 10pm daily)

- TONE WOW Sdn Bhd reserved the absolute rights acquire the Services from other Insurance Provider/ Takaful Operator to replace SOLUTIONRISK and/or ZURICH’s services provided to TONE WOW Members in FREE Takaful Personal Accident.

- TONE WOW Members agree that they shall not challenge or dispute any action or decision taken by TONE WOW, SOLUTIONRISK and ZURICH that, pursuant to the terms of this Agreement.

- TONE WOW, SOLUTIONRISK and ZURICH shall base on its sole discretion to continue or terminate the contract accordingly with or without consent from TONE WOW members.

- Terms and Conditions is subject to Master Certificate wording and please read the Product Disclosure sheet. Terms and Conditions are subject to change without prior notice..

- Where the Terms & Conditions are translated into a language other than the English Language, in the event of inconsistencies, conflicts or discrepancies between the terms and conditions set out in the English Language version and that of the other language(s), the English Language version shall prevail.

Disclaimer:

TONE WOW SDN BHD are partnering with Solution Risk Consultants Sdn Bhd (“Solution”) and Solution’s role solely as distributor of FREE Takaful Personal Accident which is underwritten by ZURICH GENERAL TAKAFUL MALAYSIA BERHAD. In no event will Solution and their respective officers, directors, employees, members, shareholders, attorneys, representatives and agents (collectively “Representatives”), be responsible or liable for any damages or losses of any kind, including but not limited to direct, indirect, incidental, consequential, special or punitive damages arising out of your entry.